Brightbook’s fast factsStarting price: $0/mo.

|

Brightbook is a simple web-based accounting software that is completely free forever, with the exception of a couple features that cost a very small fee. Brightbook does offer several advantages in addition to a completely free price tag, such as unlimited invoices and unlimited users. However, the platform lacks many features provided by other accounting software — including double-entry accounting and expense tracking.

In this Brightbook review, we investigate the platform’s features and examine its pros and cons. We also offer some Brightbook alternatives in case this free accounting software doesn’t seem advanced enough for your business.

Brightbook is completely free to sign up for and it costs $0 to use the main features. However, there are two small optional features that are behind a paywall:

Brightbook’s home screen dashboard allows you to choose between two colors: Brightbook’s signature red-pink gradient and a more subdued gray background. The design is simple and relatively easy to navigate, but it’s not very visually appealing. The interface feels outdated compared to many other competitors, including other free options such as Wave Accounting.

You can easily create a new invoice, payment, bill or client using the buttons at the top of the dashboard. The dashboard’s top bar also summarizes your current bank balance, money due in and bills due. Your invoices, payments and bills are displayed in a bar chart below. The bottom panel allows you to quickly click through invoices due, unreconciled payments, recurring invoices, unissued invoices, unpaid bills and quotes issued.

In true double-entry accounting, each transaction is recorded as a credit in one account and a debit in another. Double-entry accounting is the standard for most accounting software, but Brightbook doesn’t support this approach — there are no liability or asset accounts that you can credit or debit as needed.

SEE: What Is a Chart of Accounts? How It Works and Examples

Instead, Brightbook simply tracks money coming in and money going out. This may be enough for businesses with very simple finances, but it won’t cut it for businesses that need to track a lot of complex transactions across multiple bank accounts.

Brightbook does come with 10 invoice templates preloaded into the system, but you must pay to change them from the default. This can be enabled in Get Features > Design Your Own Template. Once you enable the paid feature, you can also create your own template by customizing the font size and color, as well as uploading your own logo. The preloaded template designs are rather simplistic and the layouts are very similar to one another as well, especially compared to the invoice templates provided by other small-business accounting software.

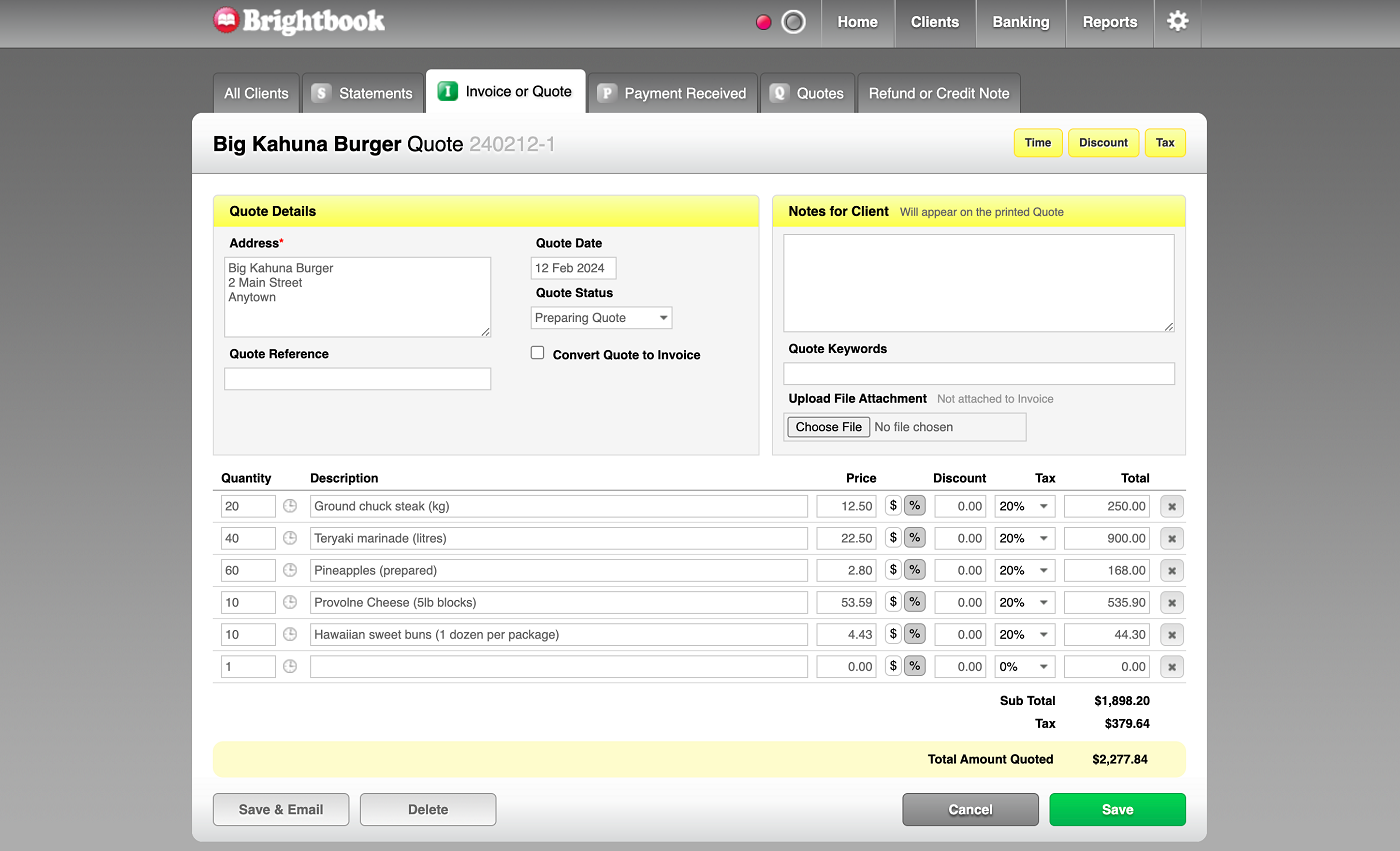

After you’ve got your templates configured however you like, you can create a new invoice by clicking on the “+ New Invoice” button on the dashboard. Select the client you want to bill, choose whether to create a quote or invoice, list your line items and add taxes and discounts if necessary. If you’ve created a quote, then you can convert it to an invoice after approval by clicking a simple checkbox. After the quote or invoice is finalized, you can email a PDF of it to your client straight from Brightbook.

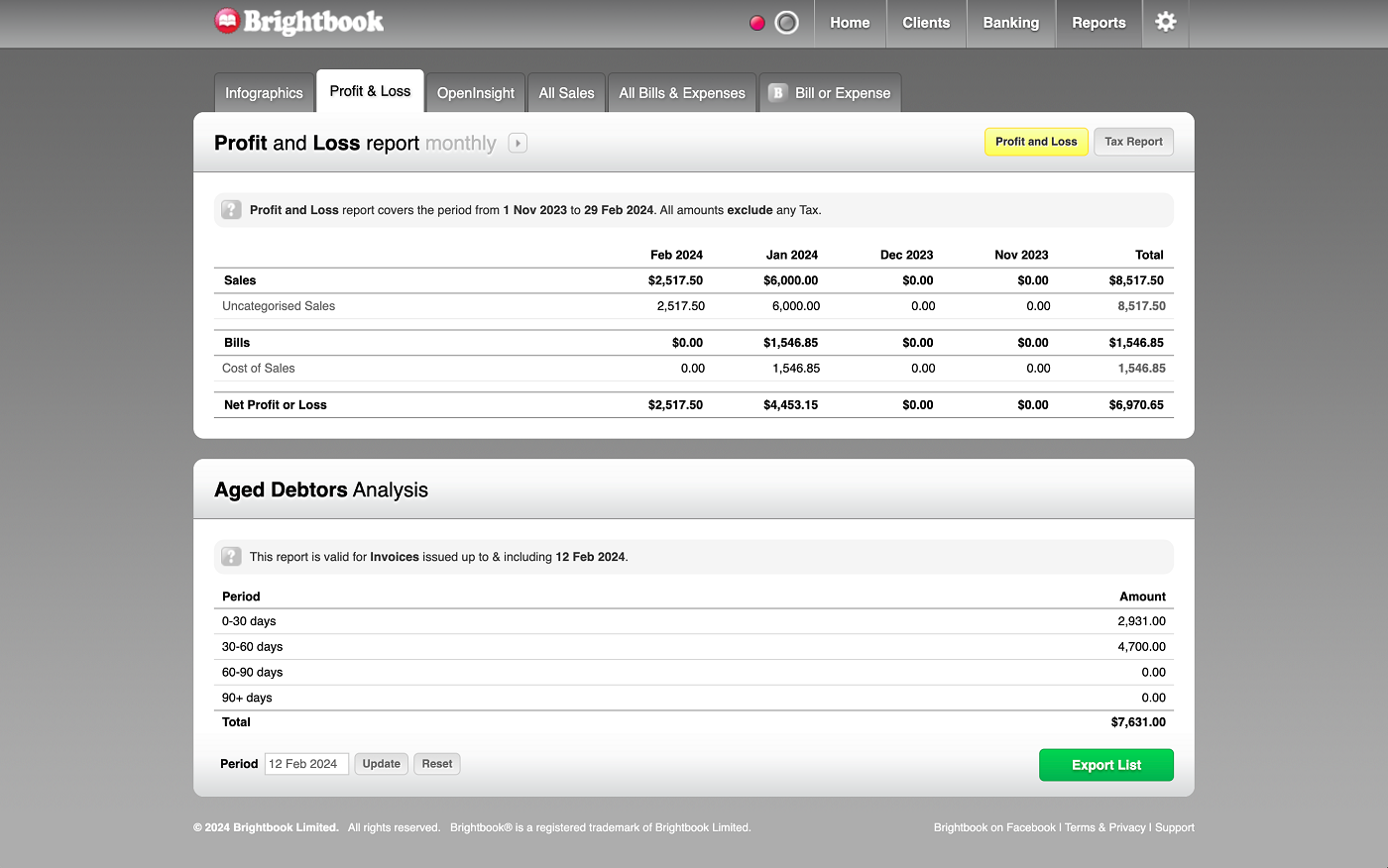

Brightbook offers a handful of very simple reports: profit and loss statements, aged debtors, all sales, all bills and expenses. There’s also an infographic that displays the monthly total of invoices, payments and bills for the last 12 months as a line chart. Meanwhile, you can use an “OpenInsight” module that tells you how your invoices and bills compare to other Brightbook clients in your industry.

While these reports may suffice for freelancers and solopreneurs, they are quite limited compared to other accounting software platforms. Business owners may find themselves seeking out more complex reporting that can give them a more comprehensive picture of their company’s financial health.

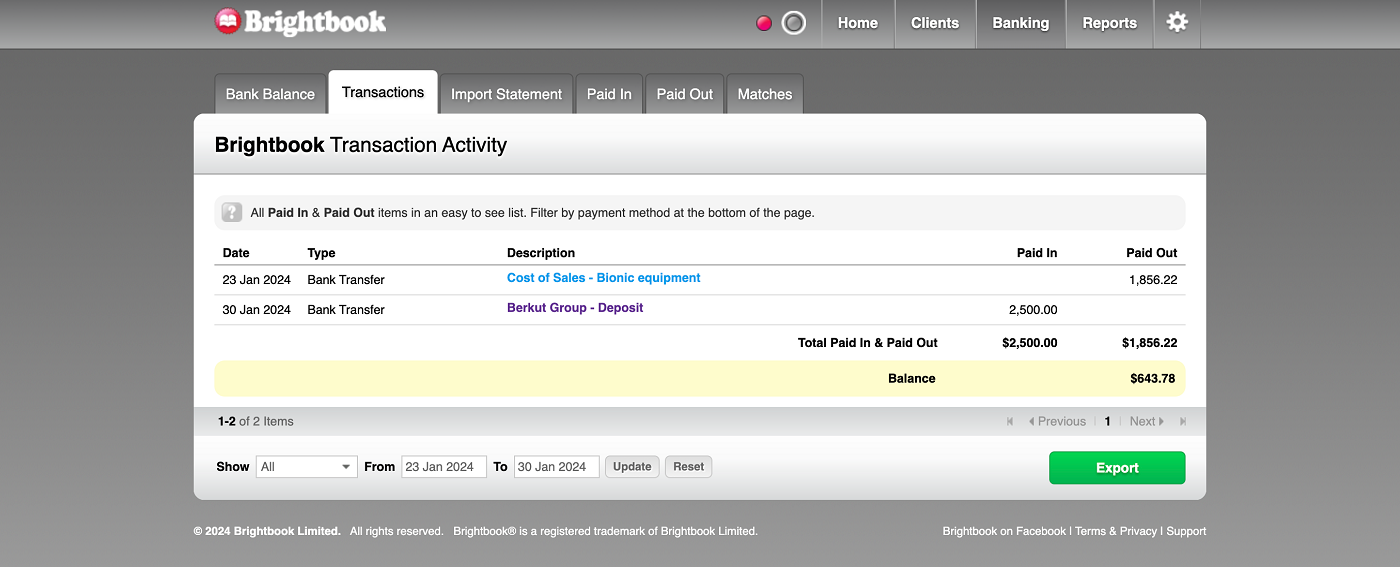

Brightbook does not offer any integrations whatsoever, even popular accounting integrations like time tracking and payroll. You can’t even link your bank account to automatically import transactions. Instead, you have to either manually add each transaction individually or download the transaction data as an OFX or QIF file and upload it to Brightbook.

Besides integrations, Brightbook lacks many different features that are common in accounting software. These features aren’t even held behind a paywall or confined to a more expensive plan — they’re simply not available. Some of the most notable missing features include inventory tracking, expense management, mile tracking and time tracking. Nor does Brightbook offer a mobile app.

All this means Brightbook is not very scalable, and you’ll need to switch to a different accounting software if you do end up needing these features in the future.

If you want a widely regarded accounting software that any accountant will know how to use, you can’t go wrong with QuickBooks. It is rather expensive, with its most affordable plan starting at $30 per month and pricing going up from there. It includes unlimited invoices, mobile receipt capture, expense tracking and mileage tracking on all plans.

Inventory tracking, time tracking and other advanced features are available on the more expensive plans. Users are capped on each pricing tier, with a maximum of 25 users for the most expensive plan.

For more information, see our full QuickBooks review.

If you are specifically looking for free accounting software, then you should definitely look into Wave, which is probably the most well-known free accounting platform. The accounting platform used to be completely free, and there is still a forever free tier that offers basic accounting features like unlimited estimates, invoices, bills and bookkeeping records.

The company recently introduced a single pricing plan that costs $16 per month and includes more advanced features like the ability to auto-import bank transactions.

For more information, see our full Wave Accounting review.

Sage software offers many different software plans for businesses of various sizes. The Sage 50 desktop accounting software starts at $595 for one license for one user for one year. It includes invoice and bill tracking, purchase order and approval, expense management, automated bank reconciliation and inventory management, among others.

If other accounting platforms aren’t complex enough for your business’ needs, then Sage 50 might be the desktop solution that you’ve been looking for.

To review Brightbook, we signed up for the free version of the software. We also consulted product documentation and user reviews. We considered features such as accounting, invoicing, billing and financial reports. We also weighed factors such as paid features, user interface design and customer support.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

5 Business Sectors Where Safety Glasses Are Essential

Annoying Things You Can Keep Out of Your Home

Easy Ways You Can Improve Your Pasture’s Quality

Mistakes You Must Avoid on Your Next Construction Project

Tips for Keeping Your Business’s Equipment Around for Longer

The Biggest Car Owner Mistakes You Must Avoid

Why Renting Construction Equipment Is Best

Beat the Heat: Summer Maintenance Tips for Forklifts

Monday’s stocks to buy include Apple, Nvidia, Tesla, Shopify and more

How to Tell If Your VPN Is Working Properly